Why My $1,000 Mistake Made Me Obsessed with Checklists

I stared at my Roth IRA balance in disbelief. A full year had passed since I'd converted $6,000 to my Roth account - and the money had been sitting there uninvested the entire time. While the market had returned over 20% that year, that $6,000 hadn't grown a penny. That expensive mistake taught me a lesson I'll never forget: even smart people make dumb mistakes when relying on memory alone. This is why I became obsessed with checklists.

Checklists are simple to use and have helped me successfully complete tasks with confidence. Using checklists has made me more productive and efficient while reducing stress and anxiety. I encourage everyone to try using checklists to experience these benefits themselves.

What is a checklist?

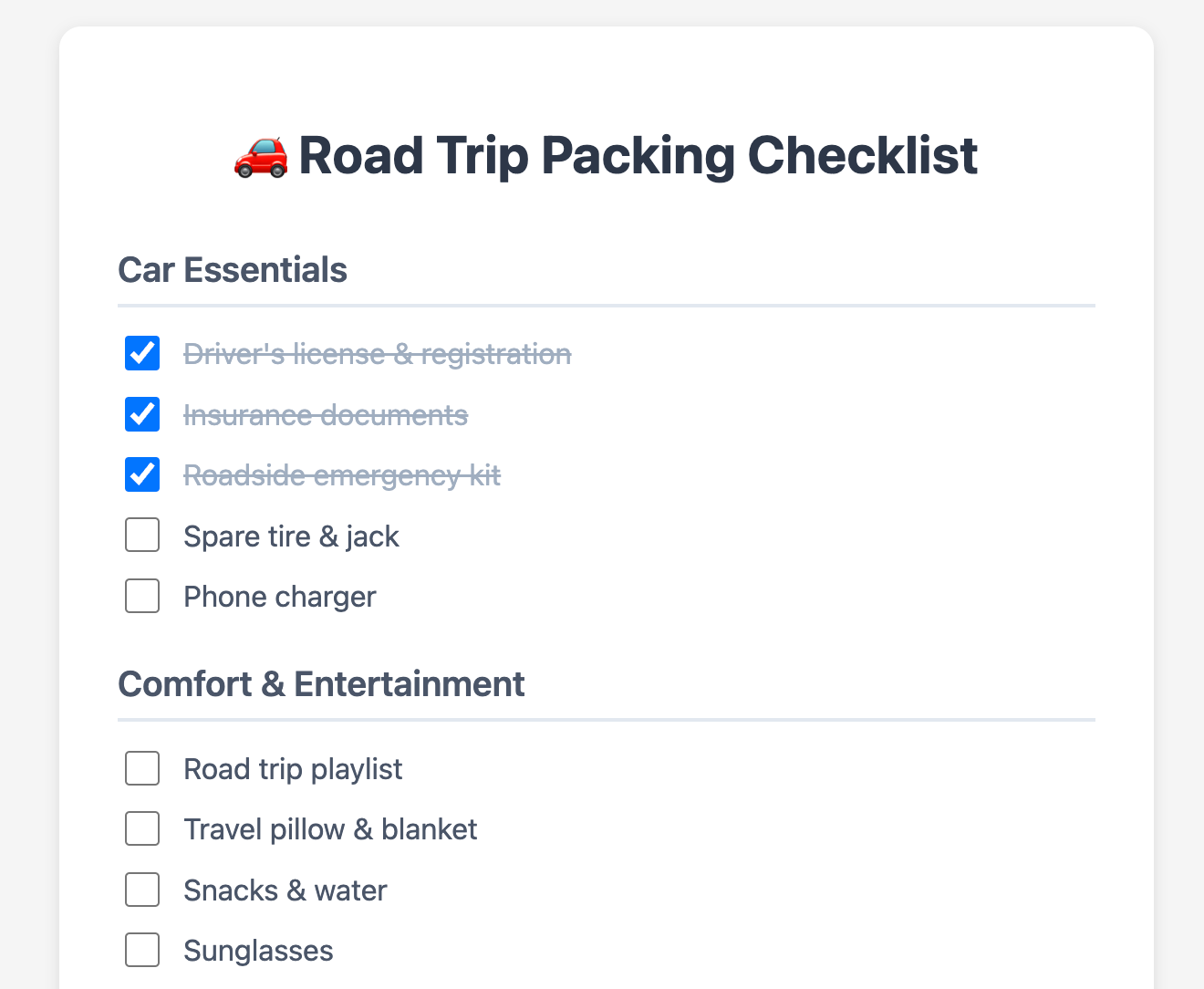

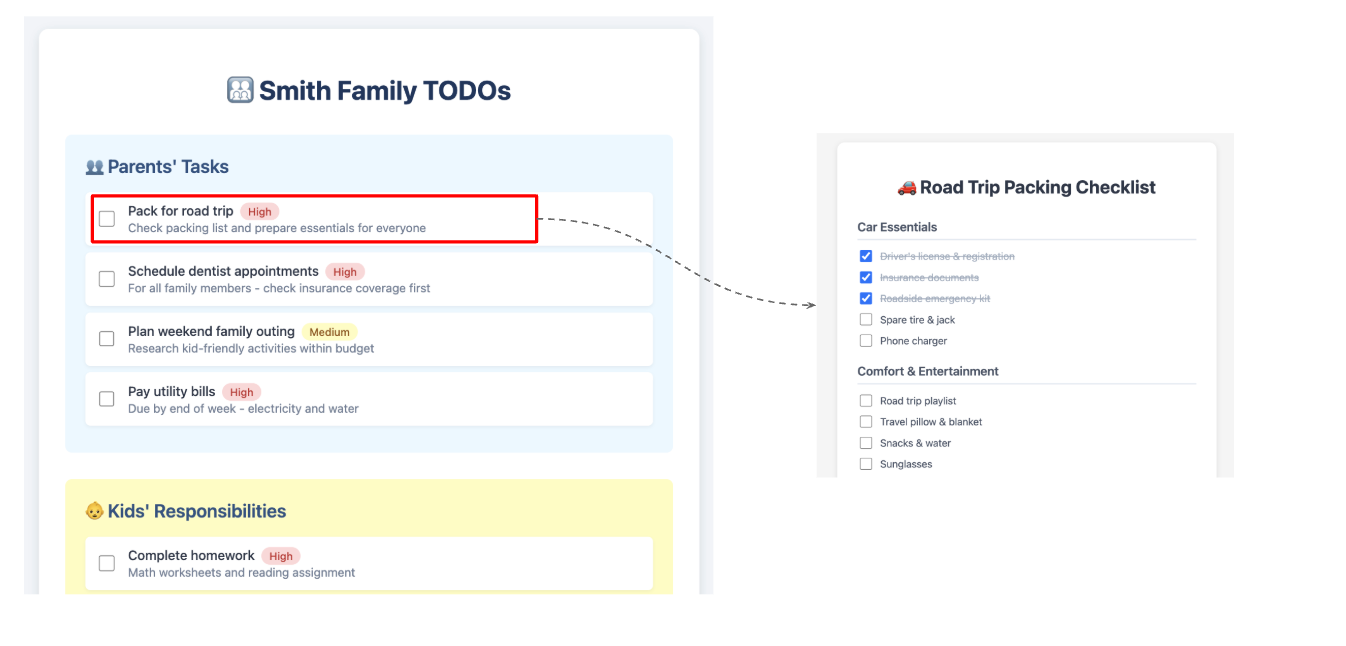

A checklist is simply a set of steps that you need to complete in order to accomplish a task. These tasks could be "Packing for a road trip" or "Filing tax returns", etc. I have found that checklists are especially useful for tasks that are repetitive or that have a lot of steps.

The Power of Checklists

I didn't fully appreciate the value of checklists when I read "The Checklist Manifesto." In that book, the author makes a compelling argument for checklists by describing how they have significantly reduced human error in high-stakes environments such as aviation and medical surgeries. At that time, I was already using lists to track TODOs, but the concept of a checklist was new to me. It wasn't until my costly Roth IRA mistake that I truly understood the power of checklists to prevent mistakes.

The key difference between a checklist and a TODO list is that the former focuses on making a specific task successful, whereas the latter tracks various tasks that you need to complete.

When to create a checklist

After seeing how a simple checklist could have prevented such an expensive mistake, I began seeing opportunities for checklists everywhere.

I began creating checklists in two types of scenarios: (1) I reactively created them after forgetting an important step while performing a task. This ensured that I didn't repeat the same mistake(s) the next time I performed the task. (2) I proactively created them before performing high-stakes tasks.

The first checklist I created was a "Personal finance" checklist, motivated by that initial Roth IRA mistake. Since then, I have reactively created checklists for various tasks such as:

Packing for various kinds of trips

Road trips

Domestic trips

International trips

Day of trip

In all of the above cases, it was a failure of some sort that prompted the creation of a checklist for that particular task. For example, my first packing checklist was prompted by a trip where I had forgotten to pack medicines, sunscreen, slippers, and even my travel toothbrush. I had actually packed in advance, so my error wasn't due to a last-minute scramble. I had simply forgotten to pack these items. I had even taken the time to run through a list of things to pack in my mind, but relying on my memory alone was clearly not sufficient. Since creating a packing checklist, I have never once forgotten to pack items on the list.

As another example, I created a separate "Day of trip" checklist when I forgot to take the trash out before heading out on a trip.

I have also proactively created checklists for important tasks like "Tax filing" where it is important to get it right the first time.

Remember to update checklists

Checklists aren't meant to be static. It is important to keep these updated over time as your needs and circumstances change. I review my checklists after each use and ask myself: "Did I miss anything?" or "Were any steps unnecessary?" For example, my travel checklist evolved significantly after having kids. Similarly, my personal finance checklist has grown to include new investment accounts and updated contribution limits. Regular review ensures your checklists remain relevant and continue to serve their purpose effectively.

Why checklists work for me

Checklists help me systematize and codify my knowledge and experience by offloading key details from memory. Instead of spending mental energy remembering every step of a complex process, I can focus on executing each step well. This reduces cognitive load and decision fatigue, especially for tasks I don't perform frequently. For instance, when doing my taxes, I don't have to worry about forgetting to report a particular type of income or missing a deduction - it's all captured in my checklist. This mental offloading also helps reduce anxiety about forgetting important steps, allowing me to perform tasks with greater confidence and clarity.

Tools for creating checklists

There are many different ways to create a checklist. I primarily use Google Sheets for complex checklists that require multiple sections or additional notes. For example, my tax filing checklist in Google Sheets has separate sections for gathering documents and reporting different types of income. Each item includes notes about where to find specific information or what to watch out for. For simpler checklists, I use Google Tasks because it's easily accessible on my phone and allows me to quickly check off items as I complete them. While there are specialized checklist apps available, I prefer these basic tools because they're free, reliable, and integrate well with my existing workflow. The most important thing is to find a method that works for you and that you will use consistently - whether that's a paper notebook, a spreadsheet, or a dedicated app.